How long do tradelines stay on credit reports?

Tradelines stay on your credit report

On average au tradelines report for 12 months – 7 years. Plenty of time to qualify and get your own credit. After you get your scores up and your accounts are aged you can earn money by letting us sell your au card slots for you..

How much does it cost to buy Tradelines?

How many Tradelines will you need?

We can give you an answer after your FREE consultation with our Credit Repair Specialist. Get Started.

Call Now! (702)758-3799

Free Tradelines, Where can you find them?

Where can you find seasoned tradelines for sale without having to pay first? You can’t. No business, not your doctor, utility company, gas station.

NO legitimate business gives away its product before being compensated. Only ID Thiefs or rip off artist would promise to give a such invaluable service for no fee upfront. This is a blatant attempt to get the credit files and all information needed to accomplish identity theft.

Seasoned Tradelines

SEASONED TRADELINES boost credit scores fast. Seasoned Tradelines also build up your credit history FAST.

Some things Our Seasoned Tradelines have been used to Qualify for:

Loans, High Limit Credit Cards, Refinancing, BMW, Cadillac, Mercedes, Lamborghini

What Are Seasoned Tradelines?

Seasoned Tradelines are credit tradelines that are at least 1-2 yrs of age.

A Seasoned tradeline boost credit scores fast. Seasoned Tradelines also build up your credit history.

The basic premise is that the tradeline (or “account”) is seasoned (or “aged”) so that when you’re added to it as an authorized user, your credit score is positively affected.

How Do Seasoned Tradelines Work?

A Seasoned tradeline can be used to increase your average age of accounts and this is a major factor in credit scoring. A seasoned tradeline may also decrease your debt-to-credit ratio, due to the fact older cards usually have higher limits than new cards.. These benefits result in an increased credit score and more credit approvals at good rates.

- There are many credit scoring models, but there’s only one that dominates the credit scoring market — It is the FICO credit score. According to myFICO.com, the FICO score developer, “90 percent of financial institutions in the U.S. use FICO scores in their decision-making process.”

FICO scores only range from 300 to 850, a higher number indicates lower risk.

A consumer only has three FICO scores, one provided by the three major credit bureaus: Experian, Equifax and TransUnion.

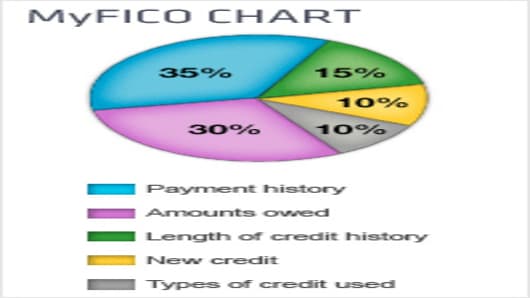

What goes into your credit score?

Information from your credit reports go into five categories that make up your FICO credit score. The credit scoring model consider some factors more than others, such as debt owed and payment history.

- Payment history: (35 percent) — payment information, including public records. and any delinquencies

- Amounts owed: (30 percent) — How much you owe on your accounts. The amount of available credit you’re using on revolving accounts is heavily weighted.

- Length of credit history: (15 percent) — How long ago you opened your accounts.

- Types of credit used: (10 percent) — The mix of accounts you have, like installment and revolving.

- New credit: (10 percent) — new credit applications, including recently opened accounts and credit inquiries.

Information such as age, marital status, income, employment, race and address don’t affect the score.

If you have any other questions, please see our faq section or